Regional Public Sector Unions are amplifying their voices on the issue of corporate tax justice. At a recent workshop hosted by Public Service International (PSI), unions sought to deepen their understanding of the impact of corporate tax policies on societies and workers, as well as discuss strategies to advocate for change.

Speaking on the Workers’ Podcast, General Secretary of the Jamaica Association of Local Government Officers, Helene Davis–Whyte, explained that unions have been monitoring this issue for almost 10 years but have only recently resolved to strengthen their involvement in the tax justice movement.

Many multinational corporations avoid taxes by cleverly shifting profits to jurisdictions where they pay little or no corporate taxes. However, according to Davis Whyte, more equitable corporate tax policies could play a critical role in increasing funding to enhance public services in the region.

ABWU's Workers' Podcast (L-R) R. Anderson Edghill, Livi Gerbase, Helene Davis–Whyte

Also speaking on the Podcast was tax researcher, Livi Gerbase. She explained that one of the important victories for the Tax Justice Movement has been a 15% global tax on multinational corporations. “It is becoming more difficult for corporate tax not to be paid…if you are not paying in one country, another country would go and charge that company for that 15%,” Gerbase elaborated.

Davis-Whyte noted, however, that there may be challenges to implementing a global corporate tax in the Caribbean.

“Although we are involved in the movement to ensure that taxation is equitable across the world, there are going to be some implications for some of our countries who have their economies largely based on these international financial centers that operate from their countries,” Davis–Whyte said.

Davis–Whyte also questioned the perceived returns on tax incentives that are offered to multinational corporations in order to encourage local investments. Making reference to the Jamaican hotel sector, Davis–Whyte noted that although such incentives resulted in the creation of jobs, these jobs were often “at the lower end of the economic ladder” and “conditions of work may not be the best.”

Gerbase called for more structures and conditionalities to be placed on tax incentives. She noted that in many countries budgetary appropriations are subjected to the rigors of parliamentary debate, whereas the issuance of tax incentives undergoes less stringent processes. “[Tax incentives] are public policies, they are specific initiatives of the government to promote a sector or promote an industry; so we need to be stricter with tax incentives,” Gerbase cautioned.

Davis–Whyte added that efforts are being made to develop a United Nations Convention on the issue of Corporate Tax Justice. She encourages union members to lobby their governments to have their voices included in these discussions at the United Nations.

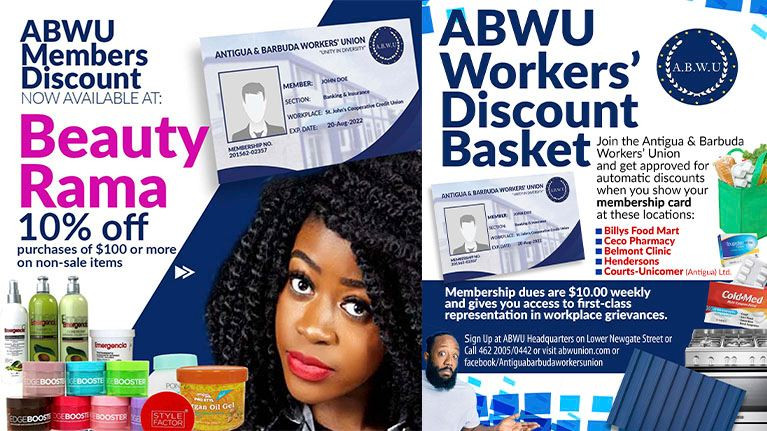

ADVERTISEMENT: